template 4

Corporate Governance

Key Performance in 2021

Improved and reviewed Anti-Corruption policy and relevant practices for clarifying and tangible implantation results

Certified ISO 27001 for Information Security Management System, and ISO 27791 Privacy Information Management from All Member’s key data management process

Promoted, educated, and supported SMEs, construction contractors to declare commitment to become part of CAC

Organized training on governance and anti-corruption, privacy data protection, and cybersecurity for all levels of employees through E-Learning

Elevated establishment of work culture in alignment with the laws, regulations and trade protocols

Risks and Opportunities

The most important point in fostering the Company to become more effective in business operations is to emphasize governance. This is the factor enhancing business competitiveness, building long-term trust for stakeholders and drawing investors’ interests, as well as a crucial approach in creating values to business and driving the Company towards sustainable growth. The Company is cognizant of business operations’ needs to be ethical, fair, transparent, and Anti-Corruption, also recognizing the importance of effective management of potential risks, under relevant governing parties’ regulations and criteria. This is in tandem with building understanding and communicating to employees at all levels for accurate implementation, minimize regulatory violation. Presently, integration of sustainability and governance is an issue stakeholders highly prioritize, it is thus a challenge to be embraced in order to continuously drive the Company’s leadership in sustainability.

Supporting the SDGs

SDG 12 Ensure sustainable consumption and production patterns

12.6 Encourage companies, especially large and transnational companies, to adopt sustainable practices and to integrate sustainability information into their reporting cycle

SDG 16 Promote peaceful and inclusive societies for sustainable development, provide access to justice for all and build effective, accountable, and inclusive institutions at all levels

16.3 Promote the rule of law at the national and international levels, and ensure equal access to justice for all

16.5 Substantially reduce corruption and bribery in all its forms

16.7 Ensure responsive, inclusive, participatory, and representative decision-making at all levels

Performance Against Goal

2030 Goal

|

|

|

|

|

The Company’s corporate governance rating is at excellence by an internationally recognized institute

| 2562 |

|

Excellence |

| 2563 |

|

Excellence |

| 2564 |

|

Excellence |

| 2021 Goal |

|

Excellence |

| 2030 Goal |

|

Excellence |

Performance Summary 2021

The Board of Directors’ Composition

Males

15 persons

Female

1 persons

Executive Directors

5 ราย

Independent Directors

6 ราย

Non-executive Directors

5 ราย

Tenure

Average tenure is at

15.61 years

Governance and Anti-Corruption Training and Assessment

CP ALL

Communicated

65,306 persons 100%

Written/Digital Acknowledgement

65,306 persons 100%

Training Provided

65,306 persons 100%

Subsidiaries

Communicated

37,951 persons 100%

Written/Digital Acknowledgement

37,951 persons 100%

Training Provided

37,951 persons 100%

Tier-1 suppliers

Communicated

4,710 persons 100%

Written/Digital Acknowledgement

4,710 persons 100%

Training Provided

3,943 persons 83.72%

Building a work culture of compliance to regulations, rules and protocols

departments with regulatory and corruption risks have been assessed

100%

departments at risks with risk management plans

100%

Breach Case

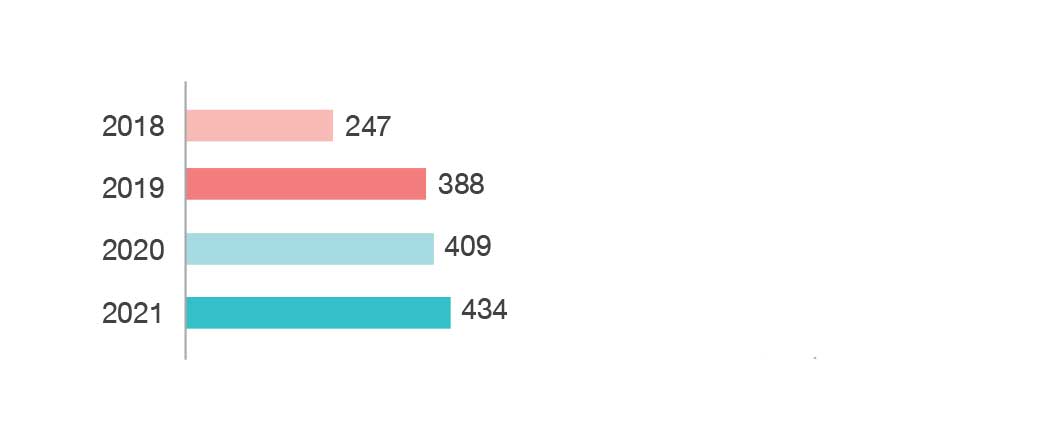

Corruption cases identified (case)

| 2021 | ||

|---|---|---|

|

Corruption found in 2021 | 434 |

|

Corruption cases investigated and confirmed in 2021 | 434 |

|

Cases resolved in 2021 | 434 |

Proportion of operations with corruption cases

7-Eleven

0.9815%

Distribution Center

0.0069%

Office

0.0115%

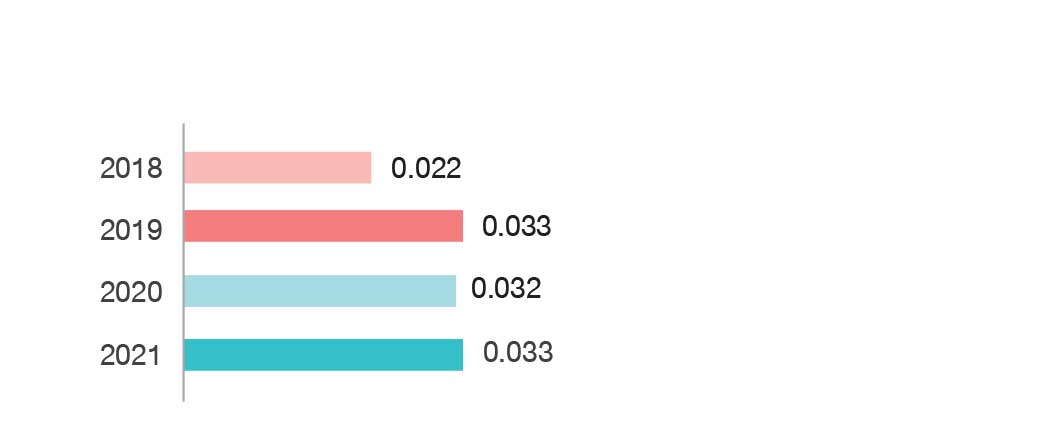

Average corruption rate at 7-Eleven stores per year (%)

Grievance regarding personal data violation (if any) investigated and confirmed

0

Customers’ data

0

Suppliers’ data

0

Regulatory bodies

Management Approach

CP ALL Public Company Limited’s conduct on governance is overseen by the Sustainability and Governance Committee, responsible in stipulating corporate governance policy, sustainability policy, Anti-Corruption policy, as well as business thics and code of conduct. Furthermore, the Committee is also tasked with continuously reviewing governance policy to ensure relevance and alignment with the compliance department’s governance principle as appropriate. Furthermore, the Company organized training on governance and Anti-Corruption of employees at all levels. There were frequent assessments to test their knowledge and understanding, committed to raising awareness and fostering knowledge as well as understanding of operations per principle of good governance and good public mind. This facilitates the Company to operate business effectively and transparently, while simultaneously moving forward to become a sustainability leader.

Notably, the impacts following the COVID-19 Pandemic drew the Board of Directors’s attention to impacts on business operations and all stakeholder groups. The Company thus makes responses accordingly by stipulating COVID-19 prevention measures for employees in the office, distribution centres and 7-Eleven stores. This includes measures for customers, such as work from home measures and 7Delivery processes to minimize contact risks for 7-Eleven employees and customers. The welfare is also extended to encompass employees’ families as well.

Good Governance Principles

1 Establish Clear Leadership Role and Responsibilities of the Board

2 Define Objective that Promote Sustainable Value Creation

3 Strengthen Board’s ffectiveness

4 Ensure Effective CEO and People Management

5 Nurture Innovation and Responsible Business

6 Strengthen Effective Risk Management and Internal Control

7 Ensure Disclosure and Financial Integrity

8 Ensure Engagement and Communication with Shareholders

ESG Issue That May Impaot Investment Performance

1. Environmental

– Resource Management

– Emission Reduction

– Environmental Accidents

– Risk Mitigation

2. Social

– Human Rights

– Community Relations

– Supply Chain Monitoring

3. Governance

– Executive Compensation

– Shareholder’s Rights

– Accountability of Board Leadership

– Vision

Corporate Governance Policy

Shareholders’ Rights

Equitable Treatments of Shareholders

Stakeholders’ Roles

Disclosure and Transparency

The Board’s Responsibility

Risk Management

Business Ethics and Code of Conduct

Anti-Corruption Policy

Prevention Against

Conflicts of Interest

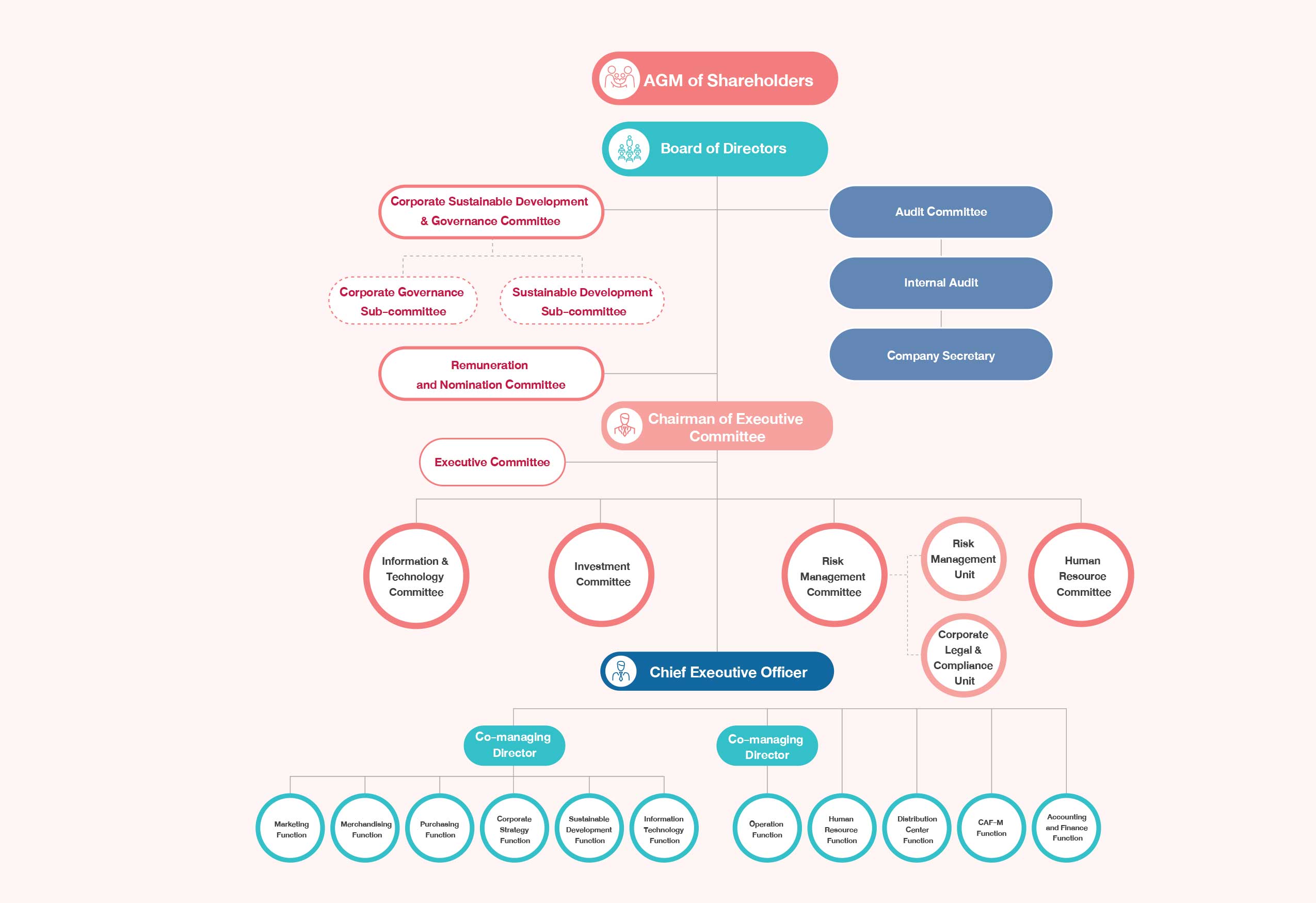

Governance Structure

Sub-committee

The Company has an independent sub-committee operation under the Board of Directors, whose crucial roles comprises:

| Audit Committee | Sustainability and Corporate Governance Committee | Remuneration and Nomination Committee |

|---|---|---|

|

|

|

Board of Director Structure

CP ALL Public Company Limited’s Board comprised of 16 directors, of which 5 were executives, 6 were independent directors, and 5 were non-executive directors. Furthermore, the Company allocated authority by dividing the authority between the chairman and the chairman of executive committee (CEC) in a distinct manner; the titleholders must be different persons. Additionally, the Company has disclosed performance regarding the Board’s technical expertise via the Board Skills Matrix, and Board Industry Experience to illustrate appropriate expertise, skills, and experience of the Company’s Board titleholders. This is in accordance with Global Industry Classification Standard (GICS), under Consumer Staples Category, enabling conducts which are responsive to the Company’s strategy, goals, and stakeholders effectively.

The Board of Directors Skill matrix

| Name of Directors | Skill Matrix of the Board of Director | |||||||

|---|---|---|---|---|---|---|---|---|

| Retail Business and Marketing | Economics Finance and Banking | Accounting and Internal Audit | Risk & Crisis Management | Digital Information Security & Cybersecurity | Business Administration and Organization | Law and Case Law | Security and Society | |

| 1. Adj. Pro. Prasobsook Boondech | ✔ | ✔ | ✔ | ✔ | ||||

| 2. Police General Phatcharavat Wongsuwan | ✔ | ✔ | ✔ | ✔ | ||||

| 3. Mr. Padoong Techasarintr | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ | |

| 4. Mr. Pridi Boonyoung | ✔ | ✔ | ✔ | |||||

| 5. Mrs. Nampung Wongsmith | ✔ | ✔ | ✔ | ✔ | ||||

| 6. Adj. Pro. Dr. Kittipong Kittiyarak | ✔ | ✔ | ✔ | |||||

| 7. Mr. Soopakij Chearavanont | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ | ||

| 8. Mr. Korsak Chairasmisak | ✔ | ✔ | ✔ | ✔ | ✔ | |||

| 9. Mr. Suphachai Chearavanont | ✔ | ✔ | ✔ | ✔ | ✔ | |||

| 10. Mr. Adirek Sripratak | ✔ | ✔ | ✔ | ✔ | ✔ | |||

| 11. Mr. Umroong Sanphasitvong | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ | ||

| 12. Mr. Narong Chearavanont | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ | ||

| 13. Mr. Prasert Jarupanich | ✔ | ✔ | ✔ | |||||

| 14. Mr. Pittaya Jearavisitkul | ✔ | ✔ | ✔ | ✔ | ✔ | |||

| 15. Mr. Piyawat Titasattavorakul | ✔ | ✔ | ✔ | ✔ | ||||

| 16. Mr. Tanin Buranamanit | ✔ | ✔ | ✔ | ✔ | ||||

-

Retail business and marketing, including expertise and work experience in logistics and distribution

-

Economics, finance and banking, including expertise and work experience in fiscal, financial institution and capital market

-

Digital Information security & cybersecurity, including expertise and work experience in E-Commerce

-

Business administration and organization management, including work experience in organization management, international business and HR management

-

Law and case-law, including expertise and work experience in the Civil and Commercial code, the Criminal code, international law and public law

-

Security and Society, including expertise and work experience in national security, information and politics/government

For more details of the Board industry experience in accordance with the GICS Level 1classification at —> Board Industry Experience

2021 Corporate Governance Survey of Thai Listed Companies

The Company participated in a corporate governance disclosure of Thai listed companies by Institute of Directors (IOD). The assessment criteria comprise 5 categories of which are: 1) Shareholders’ rights, 2) Equal treatment to shareholders, 3) Considerations to stakeholders’ roles, 4) Disclosure and Transparency, 5) the Board’s responsibilities. In 2021, the Company was assessed and ranked at Excellence or 5-star, with an above-average score compares to SET 100 Index and SET 50 Index companies in every category. Furthermore, the Company is in the Top Quartile of the Company with market capitalization of over 10,000 million Baht.

Other Information

Management Structure by the Company’s Board of Directors

1. Board of Directors

As of December 31, 2021, the Company’s Board of Directors consists of 16 members including: Executive Directors 5 persons; and Non-Executive Directors 11 persons, which are as follows: Independent Directors 6 persons (account for one-third of Board members) Non-executive Directors 5 persons (account for one-third of Board members).

Names of the Board of Directors

| Name List | Positions |

|---|---|

| 1. Adj. Pro. Prasobsook Boondech |

Independent Director, Chairman of Sustainability and Corporate Governance

Committee |

| 2. Pol. Gen. Phatcharavat Wongsuwan |

Independent Director, Chairman of Remuneration and Nomination Committee,

Sustainability and Corporate Governance Committee |

| 3. Mr. Padoong Techasarintr | Independent Director, Chairman of Audit Committee, Sustainability and Corporate Governance Committee, Remuneration and Nomination Committee |

| 4. Mr. Pridi Boonyoung | Independent Director and Audit Committee |

| 5. Mrs. Nampung Wongsmith | Independent Director and Audit Committee |

| 6. Adj. Pro. Dr. Kittipong Kittiyarak | Independent Director |

| 7.. Mr. Soopakij Chearavanont | Chairman |

| 8. Mr. Korsak Chairasmisak | Vice Chairman and Chairman of Executive Committee |

| 9. Mr. Suphachai Chearavanont | Vice Chairman and Remuneration and Nomination Committee |

| 10. Mr. Adirek Sripratak | Director |

| 11. Mr. Umroong Sanphasitvong | Director, Member of Executive Committee, Sustainability and Corporate Governance Committee |

| 12. Mr. Narong Chearavanont | Director |

| 13. Mr. Prasert Jarupanich | Director |

| 14. Mr. Pittaya Jearavisitkul | Director and Vice Chairman of Executive Committee |

| 15. Mr. Piyawat Titasattavorakul | Director and Vice Chairman of Executive Committee |

| 16. Mr. Tanin Buranamanit | Director, Member of Executive Committee, and Chief Executive Officer |

-

Directors No. 8 – 16 are Authorized Directors

-

Adj. Pro. Dr. Kittipong Kittiyarak has been appointed as an Independent director by the resolution of the Extraordinary General Meeting of Shareholders dated 12 October 2021

-

Mr. Tanin Buranamanit has been appointed as a Vice Chairman by the resolution of the Board of Directors’ Meeting dated 23 December 2021, effective from 1 January 2022

Definition

-

Executive Directors : The directors who hold a position in the management and are involved in the day-to-day operations of the organization

-

Non-Executive Directors : The directors who do not hold a position in the management, may or may not be an independent directors, and are not involved in the day-to-day operations of the organization

-

Independent Directors : Independent or outside directors who are not engaged in the day-to-day management of the organization and are not major shareholders. Furthermore, independent directors must have no such connection with a major shareholder, group of major shareholders, or other stakeholders Qualification of Directors Reference to CP All’s Board Charter

-

Authorized Directors : Certification documents of the Company stipulate that the binding signatures must include 2 authorized directors – consisting of any authorized director from both Executive1 and Non-Executive 2 members, excluding the Chairman and Independent Directors for the existence of independence in compliance with good corporate governance principles. Both directors must sign and affix the Company’s seal.

The Company’s Board plays an important role in driving the organization, entrusted with the responsibility to ensure our corporate governance approach facilitates the Company towards the objectives and the goals of creating the highest value. Good corporate governance is built on the foundation of social and environmental responsibility, equal treatments to stakeholders—guided by the Corporate Governance and Anti-Corruption Policies. The Company’s corporate governance approach, defector, complies with relevant legal requirements, corporate goals and regulations, the Board’s charters, guidelines, and resolutions, as well as Shareholders’ resolutions. More info of the Board of Directors

2. The Board of Directors Positions in Sub-Committees

There are 3 Sub-Committees under the Company’s Board of Directors – the Audit Committee, the Sustainability and Corporate Governance Committee and the Remuneration and Nomination Committee. Besides, there is one sub-committee under the Chairman of the Executive Committee which is the Executive Committee that performs duties on supervising the risk management of the Company.

Audit Committee

| 1. Mr. Padoong Techasarintr* | Chairman, Audit Committee |

| 2. Mr. Pridi Boonyoung | Member, Audit Committee |

| 3. Mrs. Nampung Wongsmith | Member, Audit Committee |

* Member of the Audit Committee possessing the relevant knowledge and experience in finance and accounting, and able to review the credibility of the Financial Statements

Sustainability and Corporate Governance Committee

| 1. Adj Pro Prasobsook Boondech* | Chairman, Sustainability and Corporate Governance Committee |

| 2. Pol. Gen. Phatcharavat Wongsuwan* | Member, Sustainability and Corporate Governance Committee |

| 3. Mr. Padoong Techasarintr* | Member, Sustainability and Corporate Governance Committee |

| 4. Mr. Umroong Sanphasitvong | Member, Sustainability and Corporate Governance Committee |

* Independent Director

Remuneration and Nomination Committee

| 1. Pol. Gen. Phatcharavat Wongsuwan* | Chairman, Remuneration and Nomination Committee |

| 2. Mr. Padoong Techasarintr* | Member, Remuneration and Nomination Committee |

| 3. Mr. Suphachai Chearavanont | Member, Remuneration and Nomination Committee |

* Independent Director

3. Summary of the Performance of the Committees for Last Year

Board of Directors’ Meeting

-

The Board of Directors’ Meeting is held once every quarter on a normal basis. Directors must regularly attend the Board of Directors’ Meetings to be informed of and jointly make decisions on the Company’s business operations. At least 7 Board of Directors’ Meetings are organized each year

-

The Company encourages all director to attend at least 75% of all board meetings held during the year by predetermined the dates of the Board of Directors’ Meetings one year in advance so that directors can arrange their schedule to attend the meeting. However, additional meetings may be called if there are special matters that require the Board’s approval or urgent matters that require the Board’s consideration. In 2021, 99.28% of the Company directors attended the Board of Directors’ Meeting

-

In 2021, a total of 9 Board of Directors’ Meetings were held which was appropriate for the duties and responsibilities of the Board and the operations of the Company in the previous year. 99% of the Directors attended the meetings. The Company also held the Non-Executive Directors Meeting in 2021 which Non-Executive Directors attended 100%

-

The meeting’s invitation, agenda and relevant documents were sent to the directors at least 7 days prior to the meeting date to allow sufficient time for the directors to study the information before decision-making. In the consideration of any issue, the directors are entitled to look at or check the related documents and ask the management to provide additional information

-

The Company has yet implemented a written policy for the minimum quorum of at least 2/3 of the Board member for board decisions to be valid to facilitate the participation in the board meeting. The Company, however, has continued to act in accordance with this rule for many years which is shown in the table of Names of the Board of Directors and Board Members Attendance. In 2021, 9 Board of Directors’ meeting were held. There were 8 meetings which all of the directors were present, and there was only one meeting which one director was absent, resulting in 93.75% of attendance rate

-

In every meeting, the management were asked questions raised by directors. The directors exercised careful, independent and transparent judgment with fair consideration for the interests of shareholders and stakeholders. Directors with vested interests in the matter under consideration must leave the meeting during consideration of that matter. The Chairman also provided sufficient time for directors to discuss problems and possible solutions. Management related to the presented agenda item were invited to the meeting to provide additional details and answer questions, which is also a good opportunity for the management to get to know the high-level executives for further job-handover

-

After the Board of Directors’ Meetings, the minutes of meeting were prepared, approved by the Board and filed at the Company Secretary Office for future reference and verification by directors and related persons. In addition, the Company Secretary coordinated to all departments to strictly perform its duties in line with the resolutions of the Board of Directors

-

In some cases, the Company organized for outside consultants or experts to provide advice or additional information to the Board of Directors, at the Company’s expense

Names of the Board of Directors and Board Members Attendance for the Year 2021

| Name List | Positions |

Board of Directors

(9 times) |

NonExecutive Directors Meeting (1 time) | Shareholders’ Annual General Meeting (1 time) | Shareholders’ Extraordinary General Meeting (1 time) |

|---|---|---|---|---|---|

| 1. Adj. Pro. Prasobsook Boondech | Independent Director | 9/9 | 1/1 | 1/1 | 1/1 |

| 2. Pol. Gen. Phatcharavat Wongsuwan | Independent Director | 9/9 | 1/1 | 1/1 | 1/1 |

| 3. Mr. Padoong Techasarintr | Independent Director | 9/9 | 1/1 | 1/1 | 1/1 |

| 4. Mr. Pridi Boonyoung | Independent Director | 9/9 | 1/1 | 1/1 | 1/1 |

| 5. Mrs. Nampung Wongsmith | Independent Director | 9/9 | 1/1 | 1/1 | 1/1 |

| 6. Adj. Pro. Dr. Kittipong Kittayarak** | Independent Director | 3/3 | 1/1 | – | – |

| 7. Mr. Soopakij Chearavanont | Chairman | 9/9 | 1/1 | 1/1 | 1/1 |

| 8. Mr. Korsak Chairasmisak* | Vice Chairman | 9/9 | – | 1/1 | 1/1 |

| 9. Mr. Suphachai Chearavanont | Vice Chairman | 8/9 | 1/1 | 1/1 | 1/1 |

| 10. Mr. Adirek Sripratak | Director | 9/9 | 1/1 | 1/1 | 1/1 |

| 11. Mr. Umroong Sanphasitvong* | Director | 9/9 | – | 1/1 | 1/1 |

| 12. Mr. Narong Chearavanont | Director | 9/9 | 1/1 | 1/1 | 1/1 |

| 13. Mr. Prasert Jarupanich | Director | 9/9 | 1/1 | 1/1 | 1/1 |

| 14. Mr. Pittaya Jearavisitkul* | Director | 9/9 | – | 1/1 | 1/1 |

| 15. Mr. Piyawat Titasattavorakul* | Director | 9/9 | – | 1/1 | 1/1 |

| 16. Mr. Tanin Buranamanit* | Director | 9/9 | – | 1/1 | 1/1 |

-

Shareholder’s Meetings were held during the pandemic of the Coronavirus Disease 2019 (COVID-19) which limited the number of meeting participants

-

* Executive Director

-

** Adj. Pro. Dr. Kittipong Kittayarak has been appointed as a Director since October 12, 2021

Assessment of the Performance of the Board of Directors

The Company has established an evaluation process of the performance of the Board of Directors of the Company and all sub-committees on an annual basis at least once a year. This is to enable the Directors of the Company to review and consider their respective performance outputs and achievements together with the various associated issues or obstacles in discharging their duties during the year, which will then enable them to improve their effectiveness as the Board of Directors through having a clearer understanding of their individual responsibilities, as well as to enhance the working relationships between the Board of Directors and the Management. The performance evaluation of the Board of Directors is divided into 2 types, that is, assessment of the overall performance of the Board of Directors as a whole and self-assessment of the performance of the individual director

Remuneration of Individual Director

The Remuneration and Nomination Committee considers payment criteria and forms of director compensation before presenting to the Board of Directors and the shareholders’ meeting for approval every year. The remuneration of directors is adjusted to be comparable to other companies in the same industry and appealing enough to attract and retain quality directors.

(1) Cash Remuneration

The 2021 Annual General Meeting of Shareholders dated 23 April 2021 approved the remuneration for directors the same rate as approved in the Annual General Meeting of Shareholders on 16 July 2020, which is also the same rate as approved in the Annual General Meeting of Shareholders on 21 April 2016, as follows:

| 1. Independent Director who is the Chairman of the sub-committee | 120,000 Baht/person |

| 2. Independent Director who is the member of the sub-committee | 100,000 Baht/person |

| 3. Independent Director who is not a member of the sub-committee | 80,000 Baht/person |

| 4. Chairman | 120,000 Baht/person |

| 5. Vice Chairman | 100,000 Baht/person |

| 6. Director | 60,000 Baht/person |

The Independent Director who is the member of several sub-committees shall receive only the highest rate of only one sub-committee. In addition, the shareholders’ meeting approved the bonus for directors at the rate of 0.50% of the dividend paid to the shareholders. The Chairman of the Board will allocate the appropriate amount of bonus to each director.

Remuneration for Directors from 1 January to 31 December 2021 (Unit: Million Baht)

| Name and Surname | Positions | Remuneration | Bonus | Total |

|---|---|---|---|---|

| 1. Adj. Pro. Prasobsook Boondech | Chairman of Sustainability and Corporate Governance Committee, and Independent Director | 1,440,000 | 3,730,000 | 5,170,000 |

| 2. Pol. Gen. Phatcharavat Wongsuwan | Chairman of Remuneration and Nomination Committee, Sustainability and Corporate Governance Committee, and Independent Director | 1,440,000 | 3,730,000 | 5,170,000 |

| 3. Mr. Padoong Techasarintr | Chairman of Audit Committee, Sustainability and Corporate Governance Committee, Remuneration and Nomination Committee, and Independent Director | 1,440,000 | 3,730,000 | 5,170,000 |

| 4. Mr. Pridi Boonyoung | Audit Committee and Independent Director | 1,200,000 | 3,110,000 | 4,310,000 |

| 5. Mrs. Nampung Wongsmith | Audit committee and Independent director | 1,200,000 | 3,110,000 | 4,310,000 |

| 6. Adj. Pro. Dr. Kittipong Kittayarak* | Independent Director | 213,333 | – | 213,333 |

| 7. Mr. Soopakij Chearavanont | Chairman | 1,440,000 | 3,730,000 | 5,170,000 |

| 8. Mr. Korsak Chairasmisak | Vice Chairman | 1,200,000 | 3,110,000 | 4,310,000 |

| 9. Mr. Suphachai Chearavanont | Vice Chairman, and Remuneration and Nomination Committee | 1,200,000 | 3,110,000 | 4,310,000 |

| 10. Mr. Adirek Sripratak | Director | 720,000 | 1,866,000 | 2,586,000 |

| 11. Mr. Umroong Sanphasitvong | Director, and Sustainability and Corporate Governance Committee | 720,000 | 1,866,000 | 2,586,000 |

| 12. Mr. Narong Chearavanont | Director | 720,000 | 1,866,000 | 2,586,000 |

| 13. Mr. Prasert Jarupanich | Director | 720,000 | 1,866,000 | 2,586,000 |

| 14. Mr. Pittaya Jearavisitkul | Director | 720,000 | 1,866,000 | 2,586,000 |

| 15. Mr. Piyawat Titasattavorakul | Director | 720,000 | 1,866,000 | 2,586,000 |

| 16. Mr. Tanin Buranamanit | Director | 720,000 | 1,866,000 | 2,586,000 |

| Total | 15,813,333 | 40,422,000 | 56,235,333 | |

* Adj. Pro. Dr. Kittipong Kittayarak has been appointed as a Director since October 12, 2021

In addition, the Company’s Audit Committee received remuneration of Baht 38,000 from a subsidiary company (Panyapiwat Institute of Management) for being their Audit Committee in 2021.

Remuneration for Directors of Subsidiaries’ company (Siam Makro Public Co., Ltd.) from January 1 to December 31, 2021 (Unit: Million Baht)

| Name and Surname | Positions | Remuneration | Bonus | Total |

|---|---|---|---|---|

| 1. Mr. Supachai Chearavanont | Chairman | 1,860,000 | 1,933,700 | 3,793,700 |

| 2. Adj. Pro. Prasobsook Boondech | Independent Director/ Member of the Nomination and Remuneration Committee | 1,260,000 | 1,511,500 | 2,771,500 |

| 3. Mr. Korsak Chairasmisak | First Vice Chairman/ Member of the Nomination and Remuneration Committee | 1,260,000 | 1,511,500 | 2,771,500 |

| 4. Mr. Umroong Sanphasitvong | Director and Member of the Corporate Governance Committee | 1,260,000 | 1,511,500 | 2,722,240 |

| 5. Mr. Adirek Sripratak | Director | 1,200,000 | 1,439,500 | 2,639,500 |

| 6. Mr. Narong Chearavanont | Director | 1,200,000 | 1,439,500 | 2,639,500 |

| 7. Mr. Prasert Jarupanich | Director | 1,200,000 | 1,439,500 | 2,639,500 |

| 8. Mr. Pittaya Jearavisitkul | Director | 1,200,000 | 1,439,500 | 2,639,500 |

| 9. Mr. Piyawat Titasattavorakul | Director | 1,200,000 | 1,439,500 | 2,639,500 |

(2) Other Remuneration

The Company has USD 40 Million of the Directors’ and Officer’s Liabilities Insurance, which the premium is approximately THB 2.5 Million per year.

Remuneration for High-level Executives

High-level Executives’ Remuneration Policy and Criteria

The Board of Directors determines the policy on high-level executives’ remuneration to be at an appropriate level, fair, and in line with their responsibility in order to meet the expectations of various stakeholder groups and comply with related laws and regulations. The Remuneration and Nomination Committee has hired an independent expert to gather information and provide advice on establishing an appropriate compensation criteria and structure for high-level executives in order to present recommendations to the Board of Directors for approval. The following factors were taken into consideration:

-

The Company’s operating results with consideration to various pre-determined business indicators

-

Comparison of the Company’s operating results with other companies in the same industry

-

Ability to develop business and improve business efficiency of each business unit each year

-

Benchmarking with remuneration rates in the same industry

In 2018, the Board of Directors considered and approved the criteria and indicators for compensating high-level executives in the form of special bonus in addition to the current bonus in order to motivate and drive executives to achieve new goals. This will be considered from achievement of 3 goals, which are, Return of Equity (ROE), customer satisfaction, and the Dow Jones Sustainability Index (DJSI) scores, which evaluate the effectiveness of business operations in accordance with the Company’s sustainable development.

Performance and key performance indicators of CEO and executives

Performance related to key performance indicators (KPIs) in the short term covers the following indicators:

-

Financial returns (e.g. return on equity : ROE, return on assets : ROA , Earnings Before Interest and Taxes : EBIT and net profit)

-

Relative financial indicators compared to companies in the same industry (e.g. business growth compared to peers)

-

Other non-financial indicators (e.g. customer perspective, internal process perspective, and sustainability perspective)

Performance aimed at building the company’s long-term performance and management capabilities and leadership capabilities that will affect the company’s long-term sustainability.

The success of these KPIs reflects returns for the Chief Executive Officer and management. There is a transparent and reasonable process for determining compensation. compensation consists of salaries, bonuses, and special pension.

The Company evaluates the performance of chief executive officers, executives, and employees annually using the Core Performance Indicators of the Organization (KPI). Performance is evaluated based on : Metrics which supports corporate KPIs and special assignments (70%) and core behaviors (30%) which is evaluated according to the behavior of Harmony & CP six core values.

CORPORATE KEY PERFORMANCE INDICATORS (KPIs)

| Perspective | Corporate Key Performance Indicators 2021 |

|---|---|

| Financial Perspective (Revenue & Profit) |

|

| Customer Perspective (Customer base & Engagement) |

|

| Internal Process Perspective (Organization Efficiency) |

|

| Sustainability Perspective (Stakeholders’ Trust) |

|

Remuneration for Executive Committee and Executive Officers (High-level Executives)

(1) Cash Remuneration

| Year | Description | No. of Executives (Person) | Remuneration (Million Baht) |

|---|---|---|---|

| 2019 | Salary bonus and special pension | 17 | 561,393 |

| 2020 | Salary bonus and special pension | 16 | 403.098 |

| 2021 | Salary bonus and special pension | 18 | 437,945 |

| 2021 Total company accumulated cash remuneration | 25,564 Million Baht |

| Payment for Executive Committee and Executive Officers | 1.71% |

(2) Other Remuneration

-

Provident Fund : The Company has established a provident fund, with the Company contributing 2 percent of monthly salary. In 2021, the Company contributed a total of Baht 8.521 million to the provident fund for high-level executives, and paid Baht 6.642 million and Baht 6.035 million in 2020 and 2019 respectively.

-

Employee Joint Investment Program (EJIP) : The Company has established an Employee Joint Investment Program (EJIP) to provide incentives and keep personnel working with the Company for a long time. The 3rd EJIP which is a five year term will end on June 30, 2022. Executives who are eligible for the EJIP must work for the Company for at least 3 years. The Company will deduct 5 percent or 7 percent (on a voluntary basis) from the employee’s monthly salary. The Company contributes 80 percent of the deductible amount from the employee in each month. In 2020 (January – May), the Company paid Baht 4.286 million for high-level executives who joined the EJIP, and paid Baht 12.205 million and Baht 11.604 million in 2019 and 2018 respectively.

Remark : Due to the COVID-19 pandemic, the Company has temporarily suspended the Employee Joint Investment Program (EJIP) starting from June 1, 2020 to relieve the burden of employees who have voluntarily joined the program, until the COVID-19 situation eases

Related Policy and Guideline

| Corporate Governance Policy | Download |

| Corporate Governance Guidelines for the Board of Directors | Download |

| Charter of the Board of Directors | Download |

| Audit Committee Charter | Download |

| Remuneration and Nomination Committee Charter | Download |

| Sustainability and Corporate Governance Committee Charter | Download |

| Corporate Legal Compliance Guideline | Download |

| Guidelines to Trade Competition Policy | Download |

| Conflict of Interest Policy and Guidelines | Download |